Homes in Plymouth

Find a home in Plymouth on Share to Buy

Welcome to Plymouth

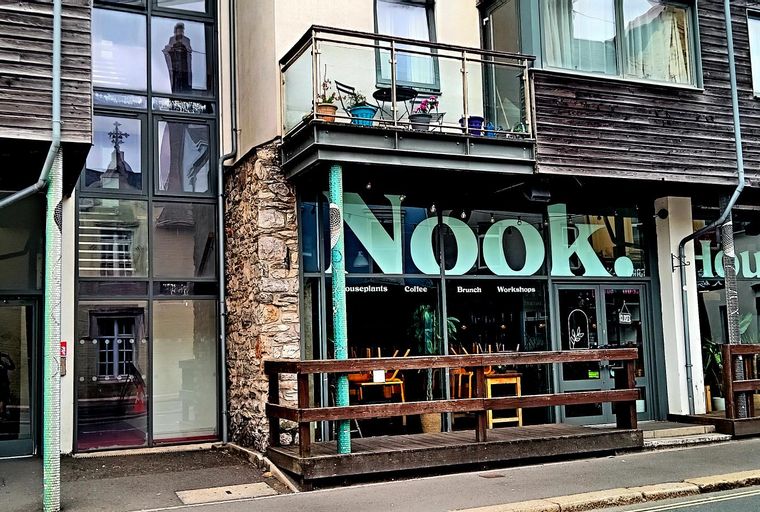

The stunning port city of Plymouth can often feel fairytale-like, with its cobbled streets and lights flickering over the rivers to the east and west. And there’s no doubt that this is a strikingly beautiful place to rest your head. However, there’s much more to Plymouth than just a port and a pretty face.

Perhaps what makes Plymouth so unique is an amalgamation of all its varied historical influences. These have given the city its interesting architecture, as well as its distinctive character. Lovers of history will find Plymouth to be an especially enchanting place to live because alongside its many fascinating museums are the living examples of history within its streets. It’s one thing to look upon history from behind a glass and quite another to spend your days walking among it. This is just one way in which living in Plymouth is different to living anywhere else.

Plymouth is also an exciting, modern city, with plenty of great attractions and things to do, meaning that life here never gets boring. For music fans, there are venues such as The Junction, The Underground and Blues Bar and Grill, to name but a few. Maybe the theatre is more your thing? If that’s the case, you can head on down to The Theatre Royale for larger productions, while Drum Theatre is a smaller, more cosy venue. There’s also places like the Plymouth Pavilion for a more diverse array of shows, including stand up comedy and live music.

On top of all this, the city boasts a truly amazing array of world-class restaurants, pubs and parks to enjoy. Things are set to improve even further too, thanks to the Plymouth 2020 Urban Redevelopment Project.

Follow the path to homeownership

Share to Buy is the country’s leading property portal dedicated to affordable homeownership and buying schemes. Our goal is to inspire, guide and empower budding buyers facing challenges in today’s housing market.

Research your options

Housing options made clear. Use our resources to learn about different home-buying and rental schemes, and work out which might be right for you.

Access our guidesCheck your affordability

Mortgages made manageable. Use our affordability calculator to work out how much you may be able to borrow to buy a home.

How much can you borrowFind your new home

It’s time to find your space. Head to our free property search tool and use filters to find your new home.

Search for homesSearch in Plymouth for your new home

Share to Buy lists thousands of properties across the country, available through affordable homeownership schemes such as Shared Ownership, First Homes, Deposit Unlock, Rent to Buy and more. Aspiring homeowners can start their search on our property portal.

If you want to keep up to date with affordable homes in Plymouth, be sure to sign up to Share to Buy and register to receive alerts.

Affordable housing options in Plymouth

What first time buyer homes are available in Plymouth? Am I eligible for homes in Plymouth? How much do new homes in Plymouth cost?

Whether you have questions about specific housing schemes, the buying process, or mortgages and affordability, we’ve got you covered. Offering a clear path to expert information, check out our FAQs and guides to learn more.

Explore Shared Ownership homes for sale in Plymouth

For budding buyers who believe that purchasing a home is out of reach, Shared Ownership houses and Shared Ownership apartments in Plymouth could help them take those vital first steps onto the property ladder. The Shared Ownership scheme is available on a variety of property types across the country, including cosy studios, stylish apartments and traditional family homes.

If you’re a first time buyer, growing family or someone looking to downsize in the South West, then a Shared Ownership home in Plymouth could be the ideal solution.

Ready to get started? Step onto the housing ladder by exploring our listing of Shared Ownership properties in Plymouth, including Shared Ownership new-build and Shared Ownership resale homes.

Affordable housing in your area

Find your way home. If you’re interested in first time buyer homes, affordable housing schemes or affordable rental options, learn more on Share to Buy.

Shared Ownership is a government scheme that allows buyers to purchase a share in a property, usually between 10% and 75%, while paying a reduced market rent to a housing association on the remainder. The scheme gives first time buyers and those that do not currently own a home the opportunity to purchase a share in a new-build or resales property.

Learn more about Shared OwnershipThe Guinness Partnership

Guinness Homes is part of the Guinness Partnership who owns and manages over 66,000 homes …

Bromford

Bromford provides stylish affordable homes through Shared Ownership.

Domovo

Domovo is the sales and marketing brand for bpha shared ownership sales. We’re here …

Plymouth · Shared Ownership Resale

Share percentage 40%, full price £285,000

Plymouth · Shared Ownership New Build

Share percentage 40%, full price £300,000

Plymouth · Shared Ownership Resale

Share percentage 25%, full price £179,000

Plymouth · Shared Ownership New Build

Share percentage 40%, full price £297,500

South Hams · Shared Ownership New Build

Share percentage 25%, full price £345,000

Plymouth · Shared Ownership New Build

Share percentage 30%, full price £330,000

South Hams · Shared Ownership New Build

Share percentage 25%, full price £375,000

Plymouth · Shared Ownership New Build

Share percentage 40%, full price £302,500

Plymouth · Shared Ownership Resale

Share percentage 40%, full price £107,000