The UK’s Top 20 Property Hotspots: Buy in these areas for the biggest property value increases

The average UK property value has increased 10% this year alone — and some locations have increased in value more than others. Where in the UK should you buy a property to watch your investment grow in value fastest? Using UK government Land Registry data, we examine the UK locations where property values have increased the most and use this information to speculate what these property hotspots could be worth in 10 years’ time if growth continues at the current rate. If you’re looking for a comfortable home that’s also a wise investment, read on to learn the UK’s top property hotspots!

Properties in North-East England rise in value fastest

If you’re looking to buy a home that’s also a solid financial investment, the North East is overall the best UK region to invest in. Property prices in the North East have nearly tripled in the last 10 years:

| Location | Average Property Value Increase |

| North East | 186% |

| South East | 82% |

| West Midlands | 61% |

| North West | 53% |

| East Midlands | 47% |

| South West | 40% |

However, this doesn’t mean you should necessarily confine your property search just to North East England…

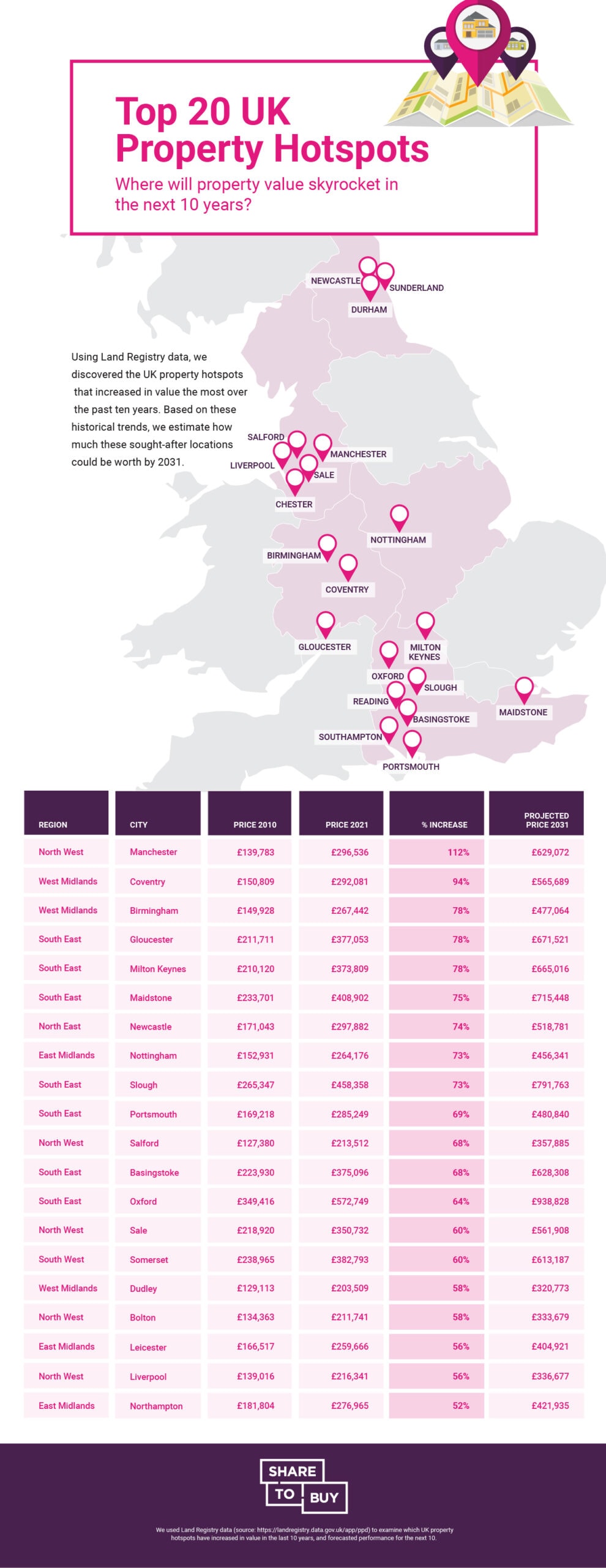

The top 20 UK property hotspots: the UK cities where property values are skyrocketing

While the North East might overall be the best region for increasing property value, this isn’t the full story. Property prices vary greatly from city to city, with some cities rising in value faster than others. By breaking down average property price changes by towns and cities, we discovered that some locations in the Midlands and the South of England have grown in value as much as the North. Here are our top 20 property hotspots in the UK outside of London:

(Click to enlarge)

What is it that makes these cities so desirable? We take a look at the UK’s top five property hotspots to see why house values are skyrocketing.

#1: Manchester — 112.1% property value increase over 10 years

At the top of our list, Manchester is a sound investment for any homeowner. The average property value in Manchester has increased from £139,783 to £296,536 over the past ten years. At this rate, the average property price in Manchester in 2031 would be around £629,000! It’s no wonder Manchester property prices are soaring faster than any other city in the UK. Manchester is one of the UK’s top locations to live in due to its wealth of entertainments, from shopping at the Trafford Centre to catching live music at the Manchester Arena and watching football at Old Trafford.

#2: Coventry — 93.7% property value increase over 10 years

Offering city life as well as countryside and open green spaces, property values in Coventry are soaring. The average property price in Coventry has increased from £150,809 in 2010 to £292,081 in 2021. At this rate, the average Coventry property value in 2031 could be around £565,869!

#3: Birmingham — 78.4% property value increase over 10 years

As the second-largest city in the UK, Birmingham is a rising property hotspot due to its broad offering of popular shopping outlets, world-renowned restaurants, scenic parks and other entertainments, including as many as 50 festivals every year. Excellent schools, universities and transport links also add to Birmingham’s appeal. Our research shows the average property in Birmingham has increased in value from £149,928 in 2010 to £267,442 in 2021. The average property value could reach around £477,000 in ten years!

#4: Gloucester — 78.1% property value increase over 10 years

Embedded in the Cotswolds and with great links to Bristol, Devon and Cornwall, Gloucester is a magnet for outdoor-lovers. Plus, excellent schools, shopping and eateries make this city a well-rounded choice for buyers looking for a long-term home. Ten years ago, the average Gloucester property was worth around £211,711. Nowadays, it’s worth over £377,053. At this rate, we project the average property in Gloucester could be valued at over £670,000 in ten years!

#5: Milton Keynes — 77.9% property value increase over 10 years

Locals of Milton Keynes enjoy living in one of the UK’s thriving economic epicentres, including fantastic commuter links to London, Birmingham and beyond. As such, homes in Milton Keynes can increase in value drastically. The average property in Milton Keynes was £210,120 ten years ago; now, it’s £373,809. This suggests the average Milton Keynes home in ten years will be roughly £665,000.

London property hotspots: in which London boroughs do property prices increase the most?

So far, we’ve only mentioned property hotspots outside London. That’s because London, with its numerous diverse boroughs, warrants a breakdown of its own. On average, property values across all London boroughs have increased 110%, making London technically second on our UK property hotspot list. However, this varies greatly from borough to borough, as some areas see steeper price rises than others:

(Click to enlarge)

See yourself buying a home in one of the UK’s growing property hotspots?

‘First-time buyers looking to get on the property ladder may wish to do so for a combination of reasons: it’s common to not just want a comfortable home to live in, but the chance to buy in an area you love, as well as making a solid investment to ensure financial wellbeing over the long term. Locations where property values steeply increase are a great option for buyers looking for not only a home but an investment; however, the initial costs in these locations are often out of reach for first time buyers.

While these projections are of course based on the current rate rather than our own forecasts, many potential purchasers are already feeling priced out of the property market in popular areas – that’s why schemes like Shared Ownership and Help to Buy exist.

These government-backed products assist buyers in climbing the property ladder by lessening the upfront deposit costs. Shared Ownership allows buyers to purchase a share of a property, while Help to Buy can help first time buyers with the assistance of an equity loan. As a result, eligible buyers who would otherwise struggle to buy can purchase properties in sought-after locations which offer a rich lifestyle and a solid return of their initial investment when the time to sell eventually comes.’

– Nick Lieb, Head of Operations, Share to Buy

Are you ready to make the big move to the home of your dreams? Search Share to Buy for modern and affordable properties in top locations today.

Method

All average house prices are based on Land Registry data for that year.